David Stockman on the Banking Ponzi Scheme That’s Savaging Depositors

October 2, 2021

The toxic effects of the Fed’s relentless interest rate repression are many, but among the worst has been the absolute savaging of bank depositors.

Interest rates on 12-month CDs (under $100,000) dropped below the inflation rate in October 2009 and have been pinned there ever since.

There is no other word for this than “expropriation” — an unconstitutional taking of property from tens of millions of households that needed to keep their funds liquid and didn’t wish to roll the dice in the junk bond market or stocks.

Worse still, the resulting vast transfer of income from depositors to banks has resulted in an egregious, artificial ballooning of bank profits and stock prices.

For instance, the combined market cap of the top six US banking institution — JP Morgan, Bank of America, Citigroup, Wells Fargo, Morgan Stanley and Goldman Sachs — has risen from $200 billion at the bottom of the financial crisis during the winter of 2008-2009, where it reflected their true value absent government bailouts, to $1.5 trillion recently.

That 7.5X gain, which was 100% orchestrated by the Fed, is an unspeakable gift to the wealthy who own most of the stocks and especially to top bank executives who have cashed-in on vastly appreciated options.

Needless to say, this massive bubble in banks and other financial stocks is unsustainable. When the Fed is finally forced to shut down its printing presses, the bank stocks will be among the first to dive into the abyss.

While this might represent condign justice from a policy and equitable point of view, the extent of the harm to everyday Americans cannot be gainsaid.

That’s because Wall Street is going for one more bite at the apple, claiming that the currently accelerating rate of inflation is good for bank stocks.

Consensus stock price forecasts for JPMorgan are up 20% by 2023 and for Goldman Sachs by 70%.

Needless to say, this is just another 11th hour lure from big money speculators looking to unload vastly overvalued stocks on unwary retail investors.

Accelerating inflation supposedly portends higher growth and loan demand, but that’s a complete humbug because what we actually see in the market is stagflation. And that will cap loan demand even as it squeezes net interest margins, causing bank earnings to fall big time.

The impending demise of bank stocks is implicit in the manner in which the $1.5 trillion scam currently reflected in the bloated market cap of the Big Six institutions came about. The Fed dominates especially the front-end of the yield curve and will bring no interference from market forces — so the screaming injustice depicted below is its deliberate handiwork.

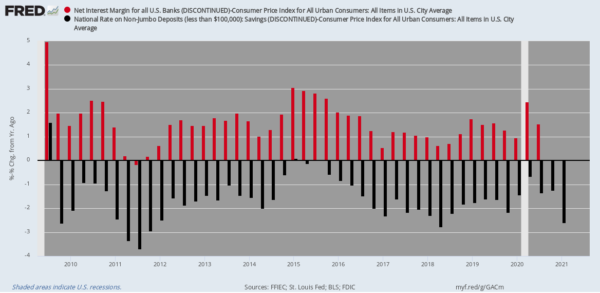

On average, the after-inflation yield during the 11-year period was -1.40%.

Inflation-Adjusted Net Interest Margin of Banks Versus Real Returns On One-Year CDs, 2009-2021

Upwards of one-fifth of the real wealth of depositors has been seized by Fed-enabled bankers during the last decade alone.

We doubt whether a more perverse reverse Robinhood redistribution could be imagined.

The Fed policy has literally turned everyday depositors (black bars) into the indentured financial serfs of the banking system (red bars).

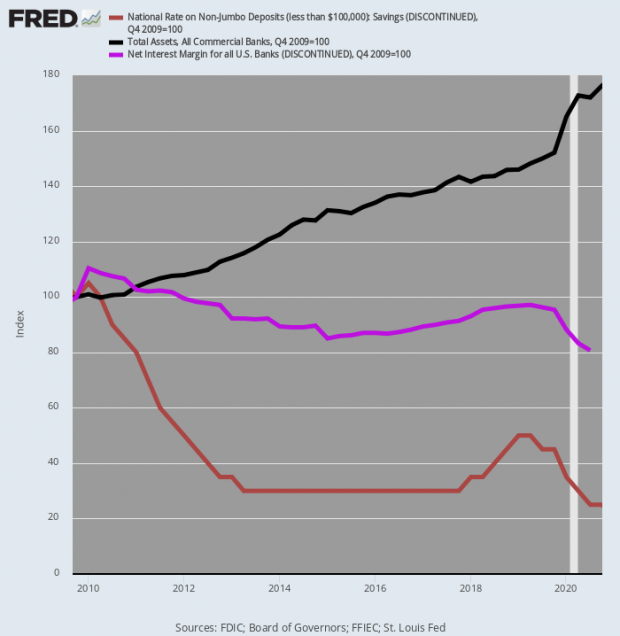

Cumulative Change in CD Rates, Total Bank Assets and Bank Net Interest Margin, 2009–2021

The chart above is indexed to Q4 2009 levels and shows that over the last 11-year period:

- CD yields fell by 75%;

- Bank net interest margins dropped by 19%;

- Total Bank assets soared by 79%.

Needless to say, the above combination did wonders for bank profitability.

On the one hand, the Fed’s money-pumping fostered an eruption of debt and other securities issuance. The aggregate balance sheets of the nation’s banks, therefore, expanded from $11.8 trillion to $21.1 trillion of total assets during the period.

Even with lower interest rates and yields on these assets, total bank interest income rose from $545 billion in 2009 to $576 billion during the last twelve months period ending in March 2021.

On the other hand, the rates banks paid depositors plunged by 50-75% depending upon deposit type and size.

In a word, the nation’s bankers not only emerged unscathed from the Great Financial crisis owing to the Washington and Fed bailouts, but during the following decade surely believed they had died and gone to bankers’ heaven.

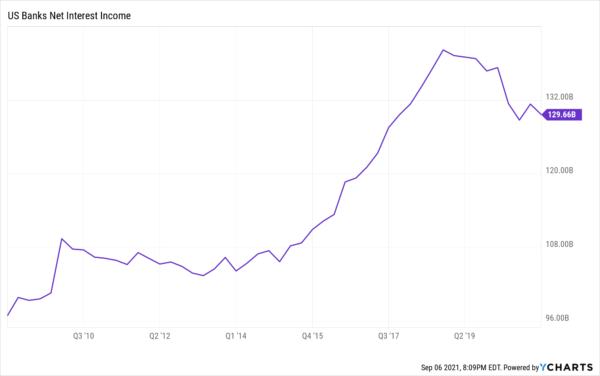

For essentially doing nothing other than scooping up their share of the tsunami of corporate and government debt and collecting nearly cost-free deposits, the net margin of the banking system rose by $122 billion per annum or 30%.

The chart below shows this ill-gotten profit gain on a quarterly basis.

Eruption of Bank Net Interest Margin, 2009–2021

Not in a million years would this have happened under a regime of sound money and honest free market pricing in the money and capital markets.

Reprinted with permission from International Man.

No comments:

Post a Comment