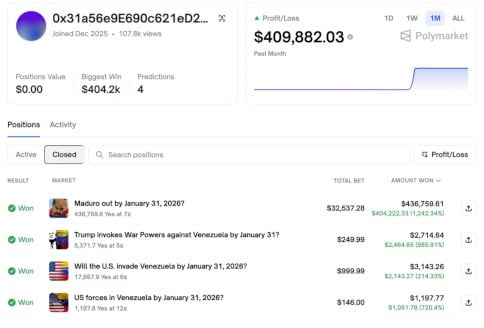

by James Corbett People ask me things. And one of the things they ask me is: James, how can I make money on all these violent, bloody regime change operations Uncle Sam is inflicting on the world? (No, I’m not joking. They really do ask me that!) Great question! Have you heard of the exciting investment opportunity in Afghanistan? Well, too bad. That opportunity is no longer available. OK, how about raking in the billions the good old-fashioned American way? You know, by forming a private security contractor and guarding the oil fields for Exxon and Chevron? Tough luck. You need to be a perpetual swamp-dweller connected to the Washington clique to enter that space. If you still want to get rich quick, then, you could be a little more deceptive. Just buy a bunch of stock options on airlines and defence contractors and office tower tenants before you gin up a spectacular false flag terror incident. We all know how well the informed trading on 9/11 turned out for certain [REDACTED] investors, after all. ...but that’s a lot of work. Instead, what if I told you that you could make bank off the bloodshed while stuffing your face with Twinkies in front of your computer? Would that interest you? Well, then, good news! That’s exactly what happened for the “lucky” person who made an extremely fortuitous bet on the ouster of Maduro right before the spectacular Smash-and-Grab Regime Change that took place on January 2nd! Wanna know how can you get in on this action yourself? Read on to find out! MEET POLYMARKETShortly before the Delta Force super soldiers went all Rambo on Maduro’s security forces, an anonymous user of Polymarket made a $32,537.28 bet that Maduro would be out of power by January 31, 2026. When that actually transpired on January 2nd, that user walked away with over $400,000. Not bad for a single “lucky” wager, huh? Wait. You’ve never heard of Polymarket? Then you’re missing out! Billing itself as “the world’s largest prediction market,” Polymarket brags that it allows users to “stay informed and profit from your knowledge by betting on future events across various topics.” Stay informed and profit from your knowledge? Sounds like a win-win to me. What does such a prediction market actually look like? If you go to the Polymarket website, you’ll see a bunch of world events that you can place bets on, from “Khamenei out as Supreme Leader of Iran by January 31?” (7% chance as of press time) and “Who will Trump nominate as Fed Chair?” (Kevin Warsh is currently the favourite) and “Will Jesus Christ return before 2027?” (only a 3% chance of the Second Coming at the moment, but if Jesus does return, boy, will your atheist friends be mad jelly when you roll by in your divinely acquired Ferrari!) Next, if you drill down on Polymarket’s documentation, you can learn how this all works. Specifically:

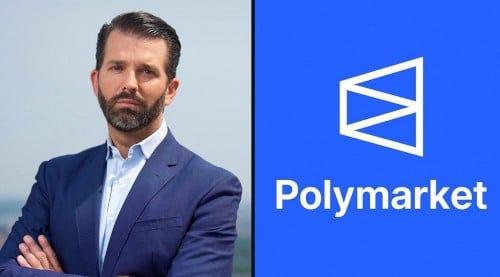

When the market is resolved—i.e., when “UMA Optimistic Oracle, a smart-contract based optimistic oracle“ decides that there is a determinative outcome to the event being gambled on—the winnings are paid out in USDC, the Ethereum stablecoin (supposedly) backed by US dollars. What’s more, Polymarket likes to brag that “the counterparty to each trade is another Polymarket user,” meaning that shares can be sold before the market is resolved and that, unlike sportsbooks, there’s “no ‘house’ to ban you for winning too much.” Well, this all sounds completely above board and legitimate! What could possibly go wrong? Oh, right. That. Yes, as it turns out, Peter Thiel’s Founders Fund helped lead a $200 million funding round for Polymarket last June. For those who don’t understand why that’s a problem, boy, do I have some reading (The Strange Story of Peter Thiel Part One / Part Two / Part Three) and viewing (Antichrist or Armageddon?) and listening (Iain Davis Exposes the Technocratic Dark State) for you! OK, so there’s the whole Thiel connection to Polymarket. But what else could go wrong? Ah, yes. Polymarket added Donald Trump, Jr. as an adviser last August after his 1789 Capital VC fund made a sizable investment in the company. Are you beginning to understand why this whole Polymarket online event-gambling thing might be a very bad idea? No? Not yet? Then let me spell it out for you. WHY DOES IT MATTER?Longtime readers of this column will remember my 2018 editorial on “How to Bet on Absolutely Anything,” wherein I discussed Augur, a then-brand-new “prediction market protocol” on the Ethereum cryptocurrency network, and Intrade, an Irish online market that was shut down by US regulators in 2012 because it was allowing people to bet on commodity prices without jumping through the proper CFTC hoops. Although the specter of assassination markets and unregulated stock trading is enough to make any statist authoritarian wet the bed in fear (and to make any bomb-throwing anarchist wet their pants with excitement), as I pointed out in that 2018 editorial, the idea did not originate with online crypto-cypher-punks and freedom zealots. Instead, it started with DARPA. That’s right, on July 28, 2003, the Defense Advanced Research Projects Agency (yes, good old DARPA) announced the Policy Analysis Market (or “PAM”). Very much like Polymarket, PAM was designed to allow traders to bet on coup d’etats, assassinations, terror attacks, wars and other major events. The working theory was that this market mechanism would help Pentagon planners predict the likelihood of such events. So, how did the public, the press and even the Congress critters react to this wonderful idea? Like this:

In fact, such was the level of scorn heaped upon the idea that the project was scrapped later the same day. (Yes, the same day!) It even caused disgraced Iran-Contra criminal John Poindexter to resign his post as DARPA’s director. Moral outrage aside, the practice of betting on coups and regime change operations and assassinations and war and other chaotic events, especially when it is done for real money and the bets are placed by anonymous entities, is a deeply flawed idea. Not only does it allow people to profit off spectacular acts of violence, and not only does it allow insiders to profit from their advance knowledge of such acts, it actively incentivizes those in positions of power to make otherwise unlikely events happen in order to receive a gigantic payday. If you were, say, the literal son of the POTUS, for example, and you wanted to make a quick half-million for some extra pocket change, it would be relatively trivial to make a quick bet on that big military operation daddy keeps talking about at the dinner table. Or if you were a billionaire vampiric technocrat and you wanted to add to your war chest, why not use your AI system to feed false info to the IAEA about Iran’s nuclear program in order to spur a military strike in Iran and then hop on over to Polymarket to place a quick bet on that strike? And WWIII? It might not turn out so great for humanity, but, given the right market odds, maybe a down-on-his-luck general could be persuaded to launch a missile here or start a shooting war there. And heck, even if things aren’t going in your favour—like, say, the Regime-Changer-in-Chief starts having second thoughts about the Iran regime change you’re gambling on—you can always use Polymarkets’ own social media to spread fake news to inflame the situation further! Are you starting to see how this “online prediction market” thing could be a very bad idea? If not, broken-clock-right-twice-a-day US Congressman Ritchie Torres—who introduced the Public Integrity in Financial Prediction Markets Act of 2026 last week to address the Polymarket fiasco—can explain it to you:

WHAT’S COMING NEXT?Alright, enough of this moral philosophizing. I mean, didn’t we establish up front that this is all about making money? Exactly. So, here’s the next question: what’s coming next? And that leads to the real question: what long-shot world-changing cataclysm gives us the best odds on Polymarket? Trump using Insurrection Act to cancel (s)elections? Step right up and place your bets!... ...but just remember, unless you’ve got inside information—or a way of making your long-shot event come to pass—you’re going to be losing money more often than not. If you’re still concerned about all this, though, don’t worry! I’m sure Ritchie Torres and his fellow Congress critters will put a swift end to this nightmare of self-fulfilling online predictions of wars, regime change operations and assassinations. Holding my breath in anticipation now... Like this type of essay? Then you’ll love The Corbett Report Subscriber newsletter, which contains my weekly editorial as well as recommended reading, viewing and listening. If you’re a Corbett Report member, you can sign in to corbettreport.com and read the newsletter today. Not a member yet? Sign up today to access the newsletter and support this work. Are you already a member and don’t know how to sign in to the website? Contact me HERE and I’ll be happy to help you get logged in! You're currently a free subscriber to The Corbett Report. For the full experience, upgrade your subscription. |

No comments:

Post a Comment