Everything Is Plunging: Stocks, Yields, Dollar Tumble as ISM, Apple Panic Spreads

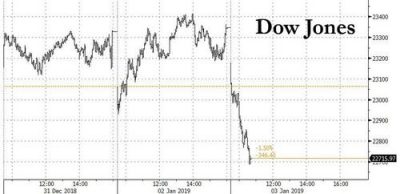

AAPL revenue guidance cut and the FX multi-flash crash, stocks took lows with the Dow plunging over 650 points this morning following the abysmal ISM Manufacturing report which showed that US mfg sentiment in December tumbled the most since October 2008.

Today’s drop has pushed the Dow to below the Dec 26 closing level, which preceded the historic 1000 point Dow move on December 27. Come to think of it, we are about 350 points from another 4-digit move in the Dow Jones, only this time to the downside.

While the S&P 500 fell more than 2%, today’s broad-based drop is being led by the Nasdaq, which is down over 3%, largely due to the Apple fiasco, which dragged the stock more than 10% lower, its biggest drop in over 5 years.

- All 30 chipmakers in the Philadelphia Semi index fell, with Qorvo, Skyworks and Broadcom off at least 4.5 percent.

- 3M, Caterpillar and DowDuPont dropped at least 3 percent.

- Bristol-Myers plunged 12 percent, while Celgene jumped 28 percent.

- Carmakers reported monthly sales; GM and Ford both retreated.

- Airlines tumbled after Delta cut its revenue forecast. American was off 9.5 percent.

“That Tim Cook and his company mentioned China as the reason behind the downturn in the company’s outlook seemed to hit exactly the pressure point traders and investors were already alarmed over,” Greg McKenna, markets strategist at McKenna Macro wrote in a client note. “That is, the China and global slowdown which seems to have been confirmed by Wednesday’s global manufacturing PMI data” and Thursday’s US ISm report.A modest boost to stocks from Bristol-Myers’ bid to buy Celgene and a strong ADP print quickly faded after the dismal ISM report hit at 10am.

Stocks weren’t the only thing in freefall: so are Treasury yields led by the belly, with the 10Y tumbling below 2.60%, and down the 2.57% last, the lowest level since January 2018. In fact, today’s sharp move can best be compared to a car crash, if only for the TSY shorts.

Meanwhile, the 1Y yield is just 2bps away from surpassing the yield on the 10Y in today’s curve inversion watch.

Finally, with US recession fears front and center, the US Dollar is also tumbling while gold is surging.

And with everything going to hell in a hand basket, gold is just waiting for the right moment to pounce.

*

Note to readers: please click the share

buttons above. Forward this article to your email lists. Crosspost on

your blog site, internet forums. etc.

All images in this article are from Zero Hedge

The original source of this article is Zero Hedge

Copyright © Zero Hedge, Zero Hedge, 2019

Comment on Global Research Articles on our Facebook page

Become a Member of Global Res

No comments:

Post a Comment