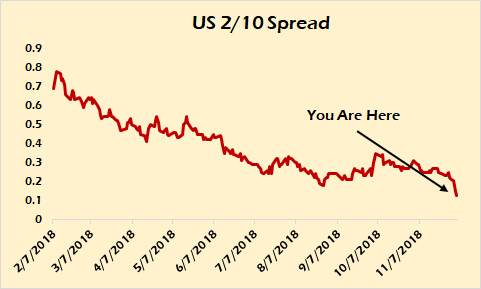

Recession Incoming or Something Worse? 2/10 Spread Collapses

December 6, 2018

UPDATE: Now stocks are selling off and the 2/10 spread is less than 10 basis points. Gold, however, refuses to sell off while the euro pulls back versus the dollar.

Mike Shedlock over at Mishtalk noted yesterday that there have been a couple of troubling inversions in the U.S. yield curve recently. They happened in the 2/3 and 3/5 year space.

Mike went on to say that the normal recession indicator, the 2/10 spread, may not invert before the economy turns down.

For further discussion, please see First Inversion in Seven Years: Can a Recession be Far Off?I don’t mean to rain on Mike’s parade, because I fundamentally agree with him that the Fed is raising rates into a global slow-down but the 2/10 spread is collapsing this morning pretty quickly.

I repeat my assessment:

- The classic recession signal that most follow is a 2-10 inversion. I doubt we see a 2-10 inversion before recession hits.

- My call: There will not be the warning nearly everyone is waiting for

Since Friday it’s gone from 21 basis points to just 13.

Or put another way:

Or put another way:

Or put another way:There’s been a lot of talk about the flattening yield curve this year, specifically the 2/10 spread because of its centrality to the lending industry. To put 13 basis points in context that’s by far the lowest of the year. And it looks today like it will continue to flatten.

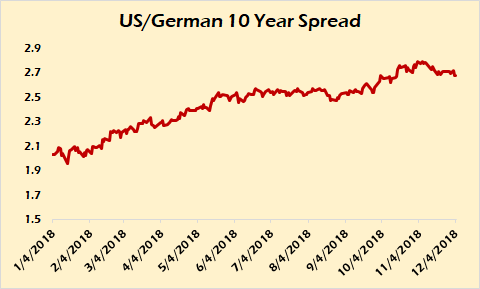

So, the U.S. Treasury markets are moving quickly to a new state. All talk of a bond rout is over as spreads between U.S. and core European debt widened all year to create an attractive yield play.

But notice how it’s flattened in recent weeks as ‘flight-to-quality’ concerns have gripped markets, most likely over Brexit worries but I think it’s deeper than that. The movement in these markets and gold tell me the worries over France’s protests, Italy’s refusal to bend the knee and growing concerns over Trump’s viability now that the Democrats have control of the House are growing.

Gold is up above $1245 while U.S. stocks are off mildly today, but they put in a strong November close, especially versus their European counterparts.

Perma-bears who refuse to look beyond the borders of the U.S. look at valuations and say, “Crash!” But the reality is that there is real fear of a political crisis all across Europe.

How an Economy Grows a...

Best Price: $2.32

Buy New $7.80

(as of 04:40 EST - Details)

We know what we’re in for here. It sucks but it’s relatively

predictable. In Europe things look like the entrenched morons running

the show know there is only spit and bailing wire holding things

together.

How an Economy Grows a...

Best Price: $2.32

Buy New $7.80

(as of 04:40 EST - Details)

We know what we’re in for here. It sucks but it’s relatively

predictable. In Europe things look like the entrenched morons running

the show know there is only spit and bailing wire holding things

together.There’s significant buying at the long end of the yield curve along with U.S. stocks. I think this is a reflection of capital flight out of Europe. Bonds can’t sell off, neither can stocks.

And now gold is trying to join the party putting in a mildly bullish Q4 after an ugly Q2 and Q3, which was the most brutal, grinding downtrend of the entire seven-year bear market.

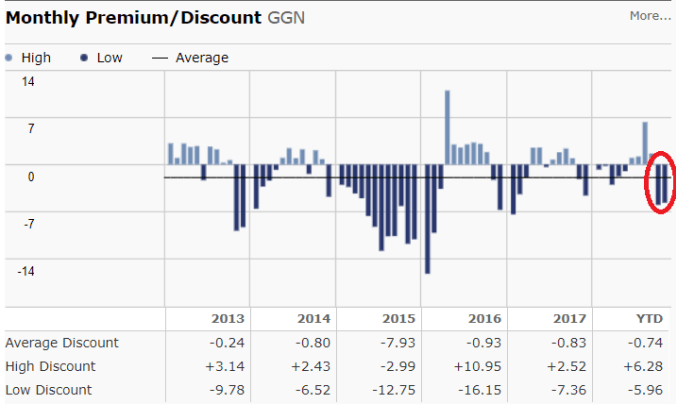

Is anyone even talking about gold at this point? Isn’t that your best contrarian indicator? If not that then how about looking at relative valuation of a major commodity fund like the GAMCO Global Gold and Natural Resources Trust (NYSE:GGN)

From Morningstar.com: GGN Premium to NAV

There comes a point where value is ultimately found out by everyone.

And if stocks and bonds are over-valued because of a decade of QE and

money printing floating all boats higher, one of two things has to

occur, either prices of those collapse or the unit of account for the

entire global economy has to rise in price. The Real Crash: Americ...

Best Price: $6.34

Buy New $8.89

(as of 11:20 EST - Details)

Even with Trump and Xi calling a trade war ceasefire the other

day, we haven’t seen a huge drop in the dollar, nor have we seen a

runaway rally in equities. The only asset to truly move into a new

short-term trading range is gold.

The Real Crash: Americ...

Best Price: $6.34

Buy New $8.89

(as of 11:20 EST - Details)

Even with Trump and Xi calling a trade war ceasefire the other

day, we haven’t seen a huge drop in the dollar, nor have we seen a

runaway rally in equities. The only asset to truly move into a new

short-term trading range is gold.And a move above the $1250 area high from a few weeks ago is very possible now that we’re looking at a world that cannot stomach rates going any higher, France is on fire, May’s Brexit deal could fail and Italy oil prices are likely done dropping.

Demand for dollars refuses to slack off. And yet gold keeps grinding higher. A flattening yield curve, rising gold, rising dollar, stocks refusing to break down. Sounds like a strange mix that is setting up for a very ugly time. When things are this cocked up it means something outside of the normal run of events is upon us.

If the Fed doesn’t raise rates next week and the ECB doesn’t announce the end of its bond-buying then we will have our answer as to how bad it will get from here.

Reprinted with permission from Gold Goats ‘n Guns.

Publisher of the Gold Goats n Guns. Ruminations on Geopolitics, Markets and Goats.

Copyright © 2018 Gold Goats ‘n Guns

Previous article by Thomas Luongo: Israel’s Pipelin

No comments:

Post a Comment