Final Catastrophe of the Currency System

By Egon von Greyerz

The fate of the global economy was

decided decades ago as deficits, debts and derivatives started their

exponential growth and reached the time bomb phase that we are now in.

This final chapter of this 100-year era will end in “a final and total catastrophe of the currency system” as von Mises succinctly articulated.

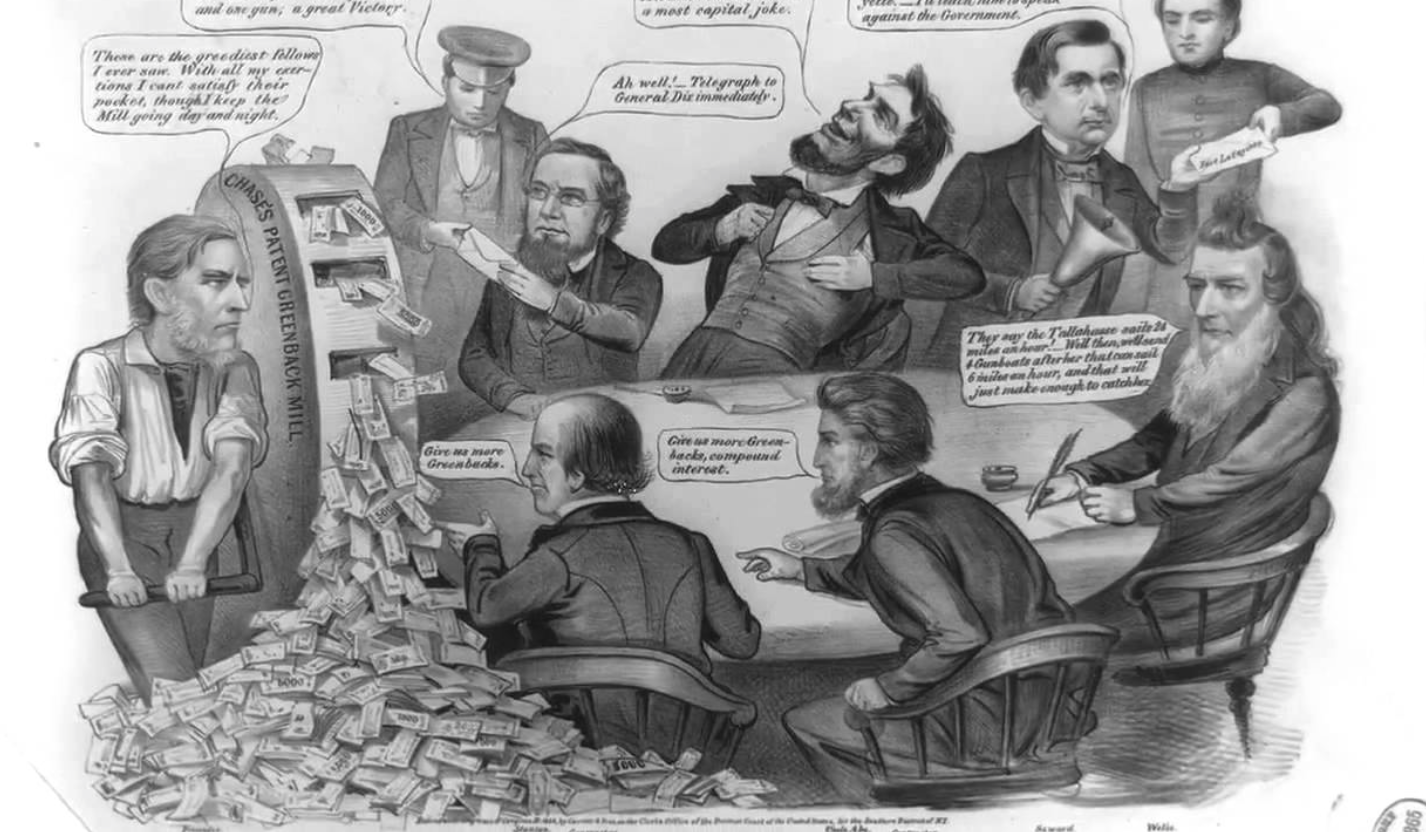

It started on Jekyll Island

It all started in 1910 when a few

senators and bankers, led by JP Morgan, secretly met on Jekyll Island

with the purpose to set up the Federal Reserve and so control the

banking system. Thus, the Fed was a creation by private bankers and for

the benefit of these bankers. Few of them could have imagined the

enormous success of their venture as the control of the financial system

led to vast fortunes for a very small elite. The back side of these

fortunes is global debt of $230 trillion plus unfunded liabilities and

derivatives. The total which is in the quadrillions is what the poor

masses in the world are liable for. Not that they will ever be able to

repay it but the implosion of these debts will lead to misery for the

majority of people for generations to come.

Critical to protect yourself against these events

Sadly, things have now gone too far to

stop the inevitable currency collapse and implosion of the financial

system but that doesn’t mean that it is too late for individuals to

protect themselves. As we enter this final phase, there will be panic in

financial markets with governments and central banks taking draconian

measures. Below are some of the potential risks that all investors must

protect themselves against today:

- Currency collapse – leading to destruction of capital

- Capital controls – making it impossible to take money out of bank or country

- Bail-ins – the bank will steal your money in order to try to save itself

- Forced investments – compulsory purchase of treasuries with your bank or pension assets

- Custodial risk – stocks and bonds will be hypothecated by the bank, leaving you nothing

- Bank failures – all your investments will disappear as the bank becomes insolvent

The above list in not exhaustive but it

contains the most likely events that will take place in the next few

years. Most private investors don’t see these risks and have zero

protection against them. And professional money managers haven’t got a

clue about real risk, nor do they see any need for protection or

insurance. When you manage OPM (Other People’s Money), you take maximum

risk in order to benefit from the upside. The downside is not your risk

and thus it can be ignored. This strategy works extremely well until the

music stops. But as long as money printing and credit creation inflates

markets, these professionals will never spend a second worrying about

the total destruction of clients’ money.

So how likely are the above risks and

how do you protect against them? Anyone who has followed some of my work

will know that I consider all the above risks as guaranteed to

materialise.

Currency collapse is

already happening with all currencies down 97-99% in the last 100 years.

The final 1-3% will happen in the next few years as governments print

unlimited amounts of money. But remember that the last 1-3% fall is 100%

from here and thus a total destruction of money. So whatever cash you

have will be totally worthless in the coming hyperinflationary phase.

Capital controls are likely to

start within 12-18 months in many countries including the US. As

deficits increase and currencies fall, governments will stop anyone from

taking money out of the bank as well as out of the country. This is

just the next step in the total control money. We have lately seen FATCA

(Foreign Account Tax Compliance), cash bans and the OECD AEOI

(Automatic Exchange of bank Information). Capital controls will be the

next logical step in an attempt to virtually confiscate money.

Governments on the road to bankruptcy will take any desperate measure to

control the people and their money.

Bail-ins are guaranteed and in

the legislation of most Western Countries. The average person has no

idea what bail-in is nor its consequences. Simply, it means that for

insolvent banks, which will be the case with most banks, governments

will not bail them out but instead depositors’ money and assets will be

used to cover the banks’ losses. Since banks are leveraged 10-50 times,

all the money belonging to the bank customers will be gone. At that

point, after the bail-in, governments will need to step in with

bail-outs. But any government intervention will be futile since they

will just create more debt to solve a debt problem.

Forced investment in treasuries

will happen as governments issue an ever increasing amount of debt. At

that point, the government will be the only buyer as we are seeing in

Japan currently. Therefore, governments will force people to put their

bank assets into treasuries to shore up the country’s finances. But then

it will of course be too late and all the money going into government

bonds will be totally worthless as these bonds go to zero.

Custodial risk means that it is

not just clients’ cash which is at risk. Any asset deposited in a bank

carries the same risk as cash. In theory stocks, bonds or physical gold

should not be in the balance sheet of the bank and therefore not be part

of a bankruptcy. Firstly, it could take years for the receiver to sort

that out. But more importantly as banks come under pressure they will

use client assets in order to shore up the assets of the bank. This was

the case for MF Global for example. We often see banks not actually

having the allocated physical gold that they have told the customer he

possesses. When banks come under pressure, they will take any desperate

measure to save themselves and this will definitely include client

assets. And don’t believe that the government will help you since they

are bankrupt too.

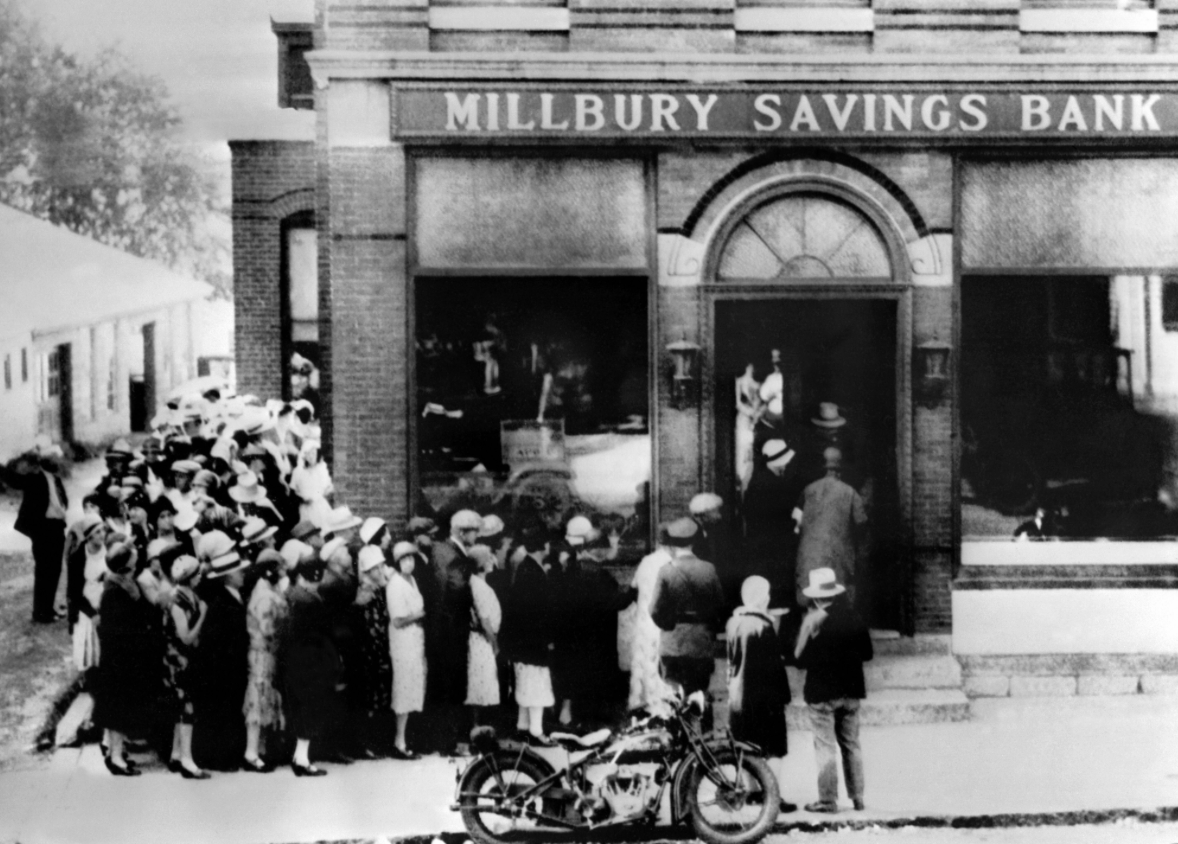

Bank failures will be commonplace

in coming years as banks’ irresponsible lending will be exposed.

Collapsing asset prices will exacerbate this problem dramatically. Most

people believe that money or assets in the bank will be totally safe.

Personally I wouldn’t deposit any major amounts of money or assets in a

bank. And if I did I would ask for collateral. Banks today are

totally untrustworthy borrowers of depositors’ money and anyone hoping

to get their money back will soon learn that they won’t.

So if you can’t trust the banks, what do

you do with your money? In uncertain times it is essential to avoid

counterparty risk. Therefore, no assets must be held with a counterparty

who is heavily exposed financially. Directly controlled assets is the

best way to control investments. This can be property, land, direct

ownership of companies including direct registration of stocks.

The best insurance money can buy

The best and cheapest insurance against

the risks outlined above is to hold physical gold and silver. But it is

not enough just to own gold and silver but just as important how they

are held. It is a sine qua non to hold metals in physical form,

outside the financial system and outside your country of residence. It

is also critical to have direct access to your wealth preservation asset

which should not be held through a counterparty.

Gold and silver will not protect

investors against all the problems that the world will experience in

coming years. But if they are held in the right way and place, precious

metals will be the best insurance against the massive wealth destruction

that will take place in the next few years.

Egon von Greyerz

Founder and Managing PartnerMatterhorn Asset Management AG

matterhorn.gold

goldswitzerland.com

No comments:

Post a Comment