“This Is Unprecedented”: Enron Liquidator Overseeing FTX Bankruptcy Speechless: “I Have Never Seen Anything Like This”

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

***

A few days ago we asked how much longer do we have to wait for the “first-day affidavit” in the FTX bankruptcy, traditionally the most detailed and comprehensive summary of how any given company collapsed into Chapter 11 (and in FTX’s case, Chapter 7 soon, as this will soon become a full-blown liquidation)…

… and this morning we finally got our answer when it hit the docket (22-11068, U.S. Bankruptcy Court for the District of Delaware), almost a full week after FTX filed on Nov 11… and boy is it a doozy.

Because how else would one describe it when FTX’s new CEO and liquidator, John Ray III, who also oversaw the unwinding and liquidation of Enron, admits that “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

And just in case his shock at FTX’s fraud of epic proportions was not quite clear enough, he adds that “from compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

Courtesy of the affidavit, here is what the company’s org chart looks like as of Nov 17:

Click here to enlarge the image.

According to Ray, he has located “only a fraction” of the digital assets of the FTX Group that they hope recover during the Chapter 11 bankruptcy. They’ve so far secured about $740 million of cryptocurrency in offline cold wallets, a storage method designed to prevent hacks. This is just a fraction of the $10-$50 billion in liabilities the company disclosed in its bankruptcy filing.

How do we know it’s a fraud: as Ray writes on page 24, although the investigation has only begun and must run its course, it is my view based on the information obtained to date, “that many of the employees of the FTX Group, including some of its senior executives, were not aware of the shortfalls or potential commingling of digital assets.” Many maybe not, but some – and certainly SBF himself – did.

It gets better: Ray said that company’s audited financial statements should not be trusted, Ray said, adding that liquidators are working to rebuild balance sheets for FTX entities from the bottom up.

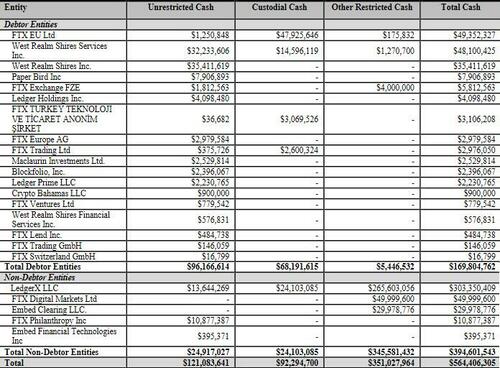

FTX “did not maintain centralized control of its cash” and failed to keep an accurate list of bank accounts and account signatories, or pay sufficient attention to the creditworthiness of banking partners, according to Ray. Advisers don’t yet know how much cash FTX Group had when it filed for bankruptcy, but has found about $560 million attributable to various FTX entities so far.

Although restructuring advisers have been in control of FTX for less

than a week, they’ve seen enough to depict the crypto company as a

deeply flawed enterprise. Lasting records of decision making are hard to

come by: Bankman-Fried often communicated through applications that

auto-deleted in short order and asked employees to do the same,

according to Ray.

Corporate funds of FTX Group were used to buy homes and other personal items for employees, Ray said.

Corporate funds were also used to buy homes and other personal items for employees and advisers, sometimes in their personal names.

“In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas,” Ray said, who also noted that the company didn’t have appropriate corporate governance and never held board meetings. There was no accurate list of bank accounts and account signatories, as well as insufficient attention paid to the creditworthiness of banking partners.

Ray said the company did not have “an accurate list” of its own bank accounts, or even a complete record of the people who worked for FTX (see below). He added that FTX used “an unsecured group email account” to manage the security keys for its digital assets.

The filing sheds light on the sloppy business practices, such as FTX employees asking to be paid through an online “chat” platform “where a disparate group of supervisors approved disbursements by responding with personalized emojis.”

Below we excerpt some of the most notable highlights from the affidavit, which we embed at the bottom of the post and which everyone should read to get a sense of just how massive Sam Bankman-Fried’s fraud was.

- I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron). I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources and systems integrity.

- Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

- For purposes of managing the Debtors’ affairs, I have identified

four groups of businesses, which I refer to as “Silos.” These Silos

include:

- (a) a group composed of Debtor West Realm Shires Inc. and its Debtor and non-Debtor subsidiaries (the “WRS Silo”), which includes the businesses known as “FTX US,” “LedgerX,” “FTX US Derivatives,” “FTX US Capital Markets,” and “Embed Clearing,” among other businesses;

- (b) a group composed of Debtor Alameda Research LLC and its Debtor subsidiaries (the “Alameda Silo”);

- (c) a group composed of Debtor Clifton Bay Investments LLC, Debtor Clifton Bay Investments Ltd., Debtor Island Bay Ventures Inc. and Debtor FTX Ventures Ltd. (the “Ventures Silo”);

- (d) a group composed of Debtor FTX Trading Ltd. and its Debtor and non-Debtor subsidiaries (the “Dotcom Silo”), including the exchanges doing business as “FTX.com” and similar exchanges in non-U.S. jurisdictions. These Silos together are referred to by me as the “FTX Group.

- Each of the Silos was controlled by Mr. Bankman-Fried.2 Minority

equity interests in the Silos were held by Zixiao “Gary” Wang and Nishad

Singh, the co-founders of the business along with Mr. Bankman-Fried.

The WRS Silo and Dotcom Silo also have third party equity investors,

including investment funds, endowments, sovereign wealth funds and

families. To my knowledge, no single investor other than the co-founders

owns more than 2% of the

equity of any Silo. - The diagram attached as Exhibit A provides a visual summary of the Silos and the indicative assets in each Silo. Exhibit B contains a preliminary corporate structure chart. These materials were prepared at my direction based on information available at this time and are subject to revision as our investigation into the affairs of the FTX Group continues.

Click here to enlarge the image.

There is much more information on each of these silos in the affidavit at the bottom of this post, but what we are curious about at this stage is what the Alameda balance sheet looks like: after all, that’s what started this whole avalanche in the first place. Here are the details:

The parent company and primary operating company in the Alameda Silo is Alameda Research LLC, which is organized in the State of Delaware. Before the Petition Date (as defined below), the Alameda Silo operated quantitative trading funds specializing in crypto assets. Strategies included arbitrage, market making, yield farming and trading volatility. The Alameda Silo also offered over-the-counter trading services, and made and managed other debt and equity investments. In short, the Alameda Silo was a “crypto hedge fund” with a diversified business trading and speculating in digital assets and related loans and securities for the account of its owners, Messrs. Bankman-Fried (90%) and Wang (10%).

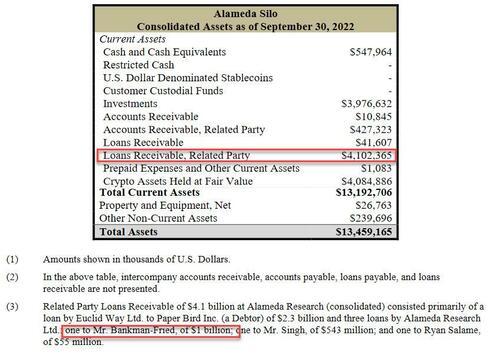

Alameda Research LLC prepared consolidated financial statements on a quarterly basis. To my knowledge, none of these financial statements have been audited. The September 30, 2022 balance sheet for the Alameda Silo shows $13.46 billion in total assets as of its date. However, because this balance sheet was unaudited and produced while the Debtors were controlled by Mr. Bankman-Fried, I do not have confidence in it and the information therein may not be correct as of the date stated.

Remarkably, among the assets listed in the document was $4.1bn of related party loans extended by Alameda, $3.3bn of which was to Bankman-Fried both personally and to an entity he controlled. Bankman-Fried previously said that FTX had “accidentally” given $8bn of FTX customer funds to Alameda.

The highlighted “related party receivable” is notable because as footnote 3 to the table reveals, it consisted of a loan by “Euclid Way Ltd. to Paper Bird Inc. (a Debtor) of $2.3 billion” and three loans by Alameda Research Ltd.: one to Mr. Bankman-Fried, of $1 billion; one to Mr. Singh, of $543 million; and one to Ryan Salame, of $55 million.

The liabilities as of September 30, 2022 were manageable. Unfortunately, the reality is that the asset and liability numbers at the consolidated level were flipped resulting in an $8 billion hole.

The problem, as we now know, is that the value of the assets was woefully overrepresented. But we’ll get to that.

First, let’s look at the immediate history that led to the bankruptcy filing:

EVENTS LEADING TO CHAPTER 11 FILING

The Debtors faced a severe liquidity crisis that necessitated the filing of these Chapter 11 Cases on an emergency basis on November 11, 2022, and in the case of Debtor West Realm Shires Inc., on November 14, 2022 (collectively, the “Petition Date”). In the days leading up to the Petition Date, certain of the circumstances described in Part III below became known to a broader set of executives of the FTX Group beyond Mr. Bankman-Fried and members of his inner circle. Questions arose about Mr. Bankman-Fried’s leadership and the handling of the Debtors’ complex array of assets and businesses.

As the situation became increasingly dire, Sullivan & Cromwell and Alvarez & Marsal were engaged to provide restructuring advice and services to the Debtors.

On November 10, 2022, the Securities Commission of the Bahamas (the “SCB”) took action to freeze assets of non-Debtor FTX Digital Markets Ltd., a service provider to FTX Trading Ltd. and the employer of certain current and former executives and staff in the Bahamas. Mr. Brian Simms, K.C. was appointed as provisional liquidator of FTX Digital Markets Ltd. on a sealed record. The provisional liquidator for this Bahamas subsidiary has filed a chapter 15 petition seeking recognition of the provisional liquidation proceeding in the Bankruptcy Court for the Southern District of New York.

In addition, in the first hours of November 11, 2022 EST, the directors of non-Debtors FTX Express Pty Ltd and FTX Australia Pty Ltd., both Australian entities, appointed Messrs. Scott Langdon, John Mouawad and Rahul Goyal of Korda Mentha Restructuring as voluntary administrators.

At the same time, negotiations were being held between certain senior individuals of the FTX Group and Mr. Bankman-Fried concerning the resignation of Mr. Bankman-Fried and the commencement of these Chapter 11 Cases. Mr. Bankman-Fried consulted with numerous lawyers, including lawyers at Paul, Weiss, Rifkind, Wharton & Garrison LLP, other legal counsel and his father, Professor Joseph Bankman of Stanford Law School. A document effecting a relinquishment of control was prepared and comments from Mr. Bankman-Fried’s team incorporated. At approximately 4:30 a.m. EST on Friday, November 11, 2022, after further consultation with his legal counsel, Mr. Bankman-Fried ultimately agreed to resign, resulting in my appointment as the Debtors’ CEO. I was delegated all corporate powers and authority under applicable law, including the power to appoint independent directors and commence these Chapter 11 Cases on an emergency basis.

Cash management… or lack thereof:

The FTX Group did not maintain centralized control of its cash. Cash management procedural failures included the absence of an accurate list of bank accounts and account signatories, as well as insufficient attention to the creditworthiness of banking partner around the world. Under my direction, the Debtors are establishing a centralized cash management system with proper controls and reporting mechanisms.

During these Chapter 11 Cases, cash that the Debtors are able to locate and transfer to the United States without adverse consequences, including substantially all proceeds of the global reorganization effort, will be deposited into financial institutions in the United States that are approved depository institutions in accordance with the U.S. Trustee Guidelines. Each Silo will have a centralized cash pool, and the Debtors will implement appropriate arrangements for allocating costs across the various Silos and Debtors. The Debtors expect to file promptly a Cash Management Motion that will describe the new cash management system in more detail.

Because of historical cash management failures, the Debtors do not yet know the exact amount of cash that the FTX Group held as of the Petition Date. The Debtors are working with Alvarez & Marsal to verify all cash positions. To date, it has been possible to approximate the following balances as of the Petition Date based on available books and records:

The Debtors have been in contact with banking institutions that they believe hold or may hold Debtor cash. These banking institutions have been instructed to freeze withdrawals and alerted not to accept instructions from Mr. Bankman-Fried or other signatories. Proper signature authority and reporting systems are expected to be arranged shortly.

Effective cash management also requires liquidity forecasting, which I understand was also generally absent from the FTX Group historically. The Debtors are putting in place the systems and processes necessary for Alvarez & Marsal to produce a reliable cash forecast as well as the cash reporting required for Monthly Operating Reports under the Bankruptcy Code.

And now it gets really good: read this section on the company’s “Financial Reporting”

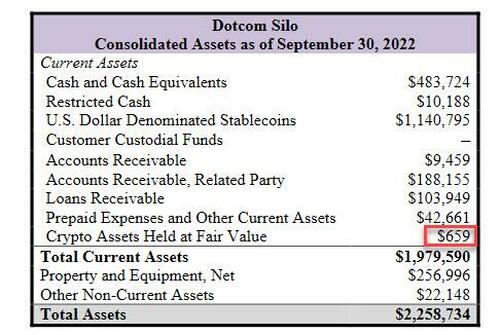

The FTX Group received audit opinions on consolidated financial statements for two of the Silos – the WRS Silo and the Dotcom Silo – for the period ended December 31, 2021. The audit firm for the WRS Silo, Armanino LLP, was a firm with which I am professionally familiar. The audit firm for the Dotcom Silo was Prager Metis, a firm with which I am not familiar and whose website indicates that they are the “first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland.

have substantial concerns as to the information presented in these audited financial statements, especially with respect to the Dotcom Silo. As a practical matter, I do not believe it appropriate for stakeholders or the Court to rely on the audited financial statements as a reliable indication of the financial circumstances of these Silos.

The Debtors have not yet been able to locate any audited financial statements with respect to the Alameda Silo or the Ventures Silo.

Next, human resources: even more insanity here.

he FTX Group’s approach to human resources combined employees of various entities and outside contractors, with unclear records and lines of responsibility. At this time, the Debtors have been unable to prepare a complete list of who worked for the FTX Group as of the Petition Date, or the terms of their employment. Repeated attempts to locate certain presumed employees to confirm their status have been unsuccessful to date.

Nevertheless, there is a core team of dedicated employees at the FTX Group who have stayed focused on their jobs during this crisis and with whom I have established appropriate lines of authority and working relationships. The Debtors continue to review personnel issues but I expect, based on my experience and the nature of the Debtors’ business, that a large number of employees of the Debtors will need to continue to work for the Debtors for the foreseeable future in order to establish accountability, preserve value and maximize stakeholder recoveries after the departure of Mr. Bankman-Fried. As Chief Executive Officer, I am thankful for the extraordinary efforts of this group of employees, who despite difficult personal circumstances, have risen to the occasion and demonstrated their critical importance to the Debtors.

… and better: here are FTX’s “Disbursement Controls”

The Debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise. For example, employees of the FTX Group submitted payment requests through an on-line ‘chat’ platform where a disparate group of supervisors approved disbursements by responding with personalized emojis.

Digital Asset Custody… and the “use of software to conceal the misuse of customer funds.”

The FTX Group did not keep appropriate books and records, or security controls, with respect to its digital assets. Mr. Bankman-Fried and Mr. Wang controlled access to digital assets of the main businesses in the FTX Group (with the exception of LedgerX, regulated by the CFTC, and certain other regulated and/or licensed subsidiaries). Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the use of software to conceal the misuse of customer funds, the secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol, and the absence of independent governance as between Alameda (owned 90% by Mr. Bankman-Fried and 10% by Mr. Wang) and the Dotcom Silo (in which third parties had invested.

The Debtors have located and secured only a fraction of the digital assets of the FTX Group that they hope to recover in these Chapter 11 Cases. The Debtors have secured in new cold wallets approximately $740 million of cryptocurrency that the Debtors believe is attributable to either the WRS, Alameda and/or Dotcom Silos. The Debtors have not yet been able to determine how much of this cryptocurrency is allocable to each Silo, or even if such an allocation can be determined. These balances exclude cryptocurrency not currently under the Debtors’ control as a result of (a) at least $372 million of unauthorized transfers initiated on the Petition Date, during which time the Debtors immediately began moving cryptocurrency into cold storage to mitigate the risk to the remaining cryptocurrency that was accessible at the time, (b) the dilutive ‘minting’ of approximately $300 million in FTT tokens by an unauthorized source after the Petition Date and (c) the failure of the co-founders and potentially others to identify additional wallets believed to contain Debtor assets.

In response, the Debtors have engaged forensic analysts to identify potential Debtor assets on the blockchain, cybersecurity professionals to identify the parties responsible for the unauthorized transactions on and after the Petition Date and investigators to begin the process of identifying what may be very substantial transfers of Debtor property in the days, weeks and months prior to the Petition Date. The Debtors’ team includes business, accounting, forensic, technical and legal resources that I believe are among the best in the world at these activities. It is my expectation that the Debtors will require assistance from the Court with respect to these matters as the investigation and these Chapter 11 Cases continue.

Additionally, Ray notes that the fair value of the crypto assets held by the FTX International exchange was just $659,000 as of September 30. As a reminder, SBF made this sound to be as large as $5.5bn just a few days ago. While the filing does not include an estimate of crypto assets owed to customers, but says they are expected to be “significant”.

As the FT notes, amid Ray’s first statements on the collapse of FTX, a jurisdictional fight over the company’s legal proceedings has emerged. Earlier in the week, Bahamian officials filed a Chapter 15 bankruptcy in a New York federal court asking a judge there to respect a liquidation effort that had commenced in the island nation.

At issue is an FTX subsidiary known as “FTX Digital” not involved in the US Chapter 11 case in which the Bahamas says significant customer assets reside. Ray on Thursday wrote in a court filing that the Chapter 15 case should be consolidated in the Delaware bankruptcy court.

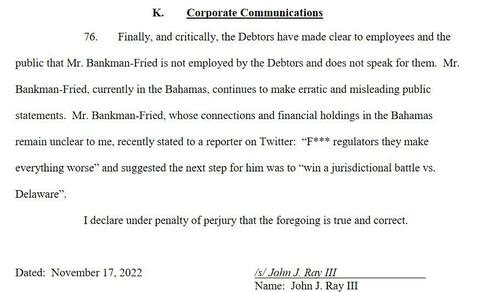

The punchline, however, was Ray’s final paragraph, a tangent on corporate communications which hardly needs discussion:

Finally, and critically, the Debtors have made clear to employees and the public that Mr. Bankman-Fried is not employed by the Debtors and does not speak for them. Mr. Bankman-Fried, currently in the Bahamas, continues to make erratic and misleading public statements. Mr. Bankman-Fried, whose connections and financial holdings in the Bahamas remain unclear to me, recently stated to a reporter on Twitter: “F*** regulators they make everything worse” and suggested the next step for him was to “win a jurisdictional battle vs. Delaware”.

To summarize:

- No record of any bank accounts

- No record of any cash accounts

- No record of any signatories

- No record of any employees

- No record of any payables or receivables

- No record of any investments

- No record of any decision-making

- No record of any board meetings

- No record of anything

And, as Bryce Weiner adds, there was also no record of any chats which were set to auto-delete, so there is no record of any internal communications.

Translation: if SBF avoids prison it is only because his tens of millions in (stolen) “donations” to Democrats have bought him a get out of jail for life card.

The full affidavit is here.

*

Note to readers: Please click the share buttons above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

No comments:

Post a Comment